We all know about the Paytm app and Paytm Personal Loan details this application is reliable for transactions to either receive or send money Paytm application is one of the best applications. Paytm has launched a Personal Loan of up to 2 lakh apply online. If you have to need an instant 2 lakh loan for personal work. So why are you waiting for? Go on the Paytm application, submit some documents, get a special offer for a loan up to 2 lakh Paytm personal loan interest rate, and get the dream amount in just 5 minutes. Paytm has given an EMI option if you won’t able to pay a large amount of personal loan just follow the Paytm personal loan process and get the dream amount.

So you can convert 2 lakh personal loan EMI very easily and the specialty of Paytm 2 Lakh Loan Interest Rate is very low compared to other banks. So don’t miss out on this offer because and get the advantage of a Paytm personal loan rate of interest for large amounts. If you are confused and don’t Decide to take or not so read Paytm personal loan reviews and get more valuable knowledge and experience and get your all answer.

Who can take a personal loan from Paytm?

Most people are confused because they don’t know whether I am eligible or not for Paytm Personal Loan. So we provide an easy way to get to know whether you can able or not for Paytm Loan.

- If you are an Indian citizen, you can easily take Paytm Personal Loan Eligibility.

- If you are over 18, you can get a loan.

- You must have a bank account and the Paytm App, which you should have installed on your mobile.

Read More: HDFC Personal Loan Eligibility

What documents will be required to get a Paytm Personal loan?

Before applying for this loan you can get all the information about the Paytm personal loan document.

- Aadhar card

- Bank Account number

- Pan Card

Paytm Loan Apply Online After Paytm App Download.

- First of all on your phone Paytm App Download or update it

- After updating you have to open the Paytm App

- You have to click the Personal Loan Search button.

Click Here for Axis Bank Personal Loan

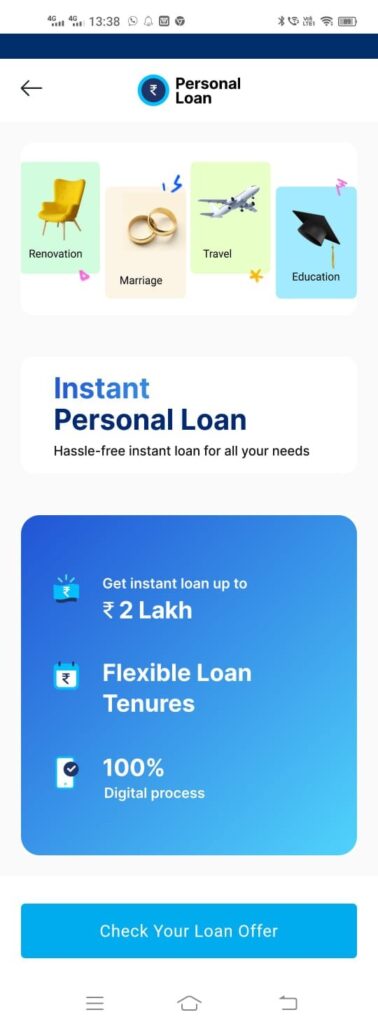

- Then you will see a new page Instant Personal Loan 200000 on your screen

- Paytm can take loans ranging from Rs. 10,000 to Rs. 2 lakh.

- If you see below, after you click on check your loan offer, you will open a new page and come in front of you, in which you have to give complete information of PAN card ? such as pan number, email id, etc.

Raed More: State Bank Of India Personal Loan Eligibility

- Now you have to tell why you need a loan and what need.

- So you can click on the button – Purpose of Loan – & you can tell which purpose of the loan you need.

- A little additional information has been asked that what you do

- If you are self-employed, you will click the self-employed button

- Then scroll down & fill in some information regards self-employed like father name mother name etc.

- Submit Your Information then Click Conformed Button

- A new page will open, and you will fill in some information & will ask for some numbers we need your alternate mobile number to approve your loan.

- Your phone number & Aadhar card must link to your bank account.

- Your CIBIL SCORE for the loan must be 700+ otherwise It will be difficult to get a loan.

How to Paytm App Download to Get Paytm Personal Loan Offer

We know in complete detail how to Paytm app download very easily. If you have an android phone then you have 2 options for the Paytm App download in a minute. Just follow some steps and download now.

- The first option is very easy to open your mobile phone and visit the google play store

- Search in google play store Paytm App and click to install and download Paytm App now and fill in your personal detail

- Second option Paytm Official Website just search on google and visit Paytm website and create your account and Paytm App download.

How Much Paytm Personal Loan Interest Rate will You Pay After Applying?

When you are applying a Paytm personal loan to complete your desire. So before apply a Paytm Personal loan you much know how much interest rate your will pay on your loan amount. After getting complete knowledge you can easily pay your loan installment. Because many banks are fraud with you. So get complete knowledge about Paytm Personal Loan Interest Rate.

- Your interest rate depends on your amount of loan

- When your loan offer comes on your screen, all the details will open in front of you.

I hope this information helps to get a Personal Loan from Paytm

FAQs

Ans – Yes Paytm give a loan in small and large amount very easily within a minute. No more documentation is required, and no extra charges.

Ans – Yes, Paytm Monthly Rate of Intrest is 1.66% Per Month. So that you can afford it very easily.

Ans – That is a transition through Paytm UPI. Paytm give a Daily transaction limit of Rs. 1 lakh by using Paytm UPI